tesla tax credit 2021 georgia

The federal solar investment tax credit will have the biggest impact on the cost you will face to go solar in Georgia. Anyone else delaying their 2021 Tesla purchase to.

Latest On Tesla Ev Tax Credit March 2022

On top of the initial 4000 tax credit you get an extra 3500 if the battery pack is at least 40 kilowatt-hour.

/ap814720993638-5bfc383d46e0fb0051c14a81.jpg)

. If you purchased either of these vehicles in 2021 they are not eligible for a tax credit. La loi de finances pour 2021 instaure un nouveau barème du malus automobile applicable depuis le 1er janvier 2021 aux véhicules thermiques. Tesla tax credit 2021 georgia.

The maximum credit is 500 for vehicles with a gross vehicle weight rating GVWR of 10000 pounds lbs or less and 1000 for vehicles with a GVWR of more than 10000 lbs. Remember there are a number of taxes and I believe that they vary. Federal solar investment tax credit.

Depending on your location state and local utility incentives may be available for electric vehicles and solar. For Teslas bought on or after January 1 2020 there has been no federal tax credit. Le seuil dapplication du malus pour 2021 est fixé à 133 g de CO2 par km puis 129gCO2 par km à.

Les Tesla némettant aucun rejet de CO2 à lusage elles ne sont pas soumises au Malus Ecologique. This is 26 off the entire cost. Statutorily Required Credit Report.

FAQ for General Business Credits. Posted by 1 year ago. This credit was originally adopted by the state in 2001 three years before Tesla began development of its first model the Tesla Roadster and nine years before the introduction of the.

Not eligible Key selling points. Both Tesla and GM have finished this process. 20 of the vehicle cost up to 5000 if you purchase or lease a zero emission vehicle ZEV.

If you install your photovoltaic system in 2020 the federal tax credit is 26 of the cost of your solar panel system. According to Mark Steber chief tax information officer at Jackson Hewitt if we assume only a standard deduction and no other credits a single filer will need an income of 65964 in 2021 up. 358 miles Federal EV tax credit.

10 of the vehicle cost up to 2500 if you purchase or lease a low emission vehicle LEV. Rebates are available through December 31 2021. The committee voted to advance this with 14 Democrats in favor.

Seventy Five 75 of mileage must be accumulated in Georgia each year for a five year period. Solar energy and utilities can also earn you a. This perk is commonly known as the ITC short for Investment Tax Credit.

The federal solar investment tax credit will have the biggest impact on the cost you will face to go solar in Georgia. 7500 Purchase an electric or plug-in hybrid vehicle defined as a car with a battery capacity of at least 40 kilowatt-hours and a gas tank if any under 25 gallons 4500 If the car was assembled at a unionized US. The vehicle must stay registered in Georgia for no less than 5 years.

The total amount of tax credit for a taxpayer or affiliated entity shall not exceed the lesser of taxpayers income tax liability or 25000000. Georgia Tax Center Information Tax Credit Forms. Income Tax Credit Policy Bulletins.

How Much is the Electric Vehicle Tax Credit for a 2021 Tesla. Heres how you would qualify for the maximum credit. Federal Incentives All electric and plug-in hybrid cars purchased in or after 2010 may be eligible for a federal income tax credit of up to 7500.

If you purchased or leased a vehicle on or before this date you can get a Georgia income tax credit of. February 11 2021 Tesla to get access to 7000 tax credit on 400000 more electric cars in the US with new incentive reform Fred Lambert - Feb. Income tax credit of up to 50 for the equipment and labor costs of converting vehicles to alternative fuels including electric.

1 The Infrastructure Investment and Jobs Act passed in 2021 but it does not contain EV tax creditsIt does include 75 billion for building EV charging stations although this has little effect on Tesla which already has its own. Anyone else delaying their 2021 Tesla purchase to take advantage. With the two added the EV credit you get is 7500.

20 of the vehicle cost up to 5000 if you purchase or lease a zero emission vehicle ZEV. Qualified Education Expense Tax Credit. Currently only GM Ford and Stellantis qualify.

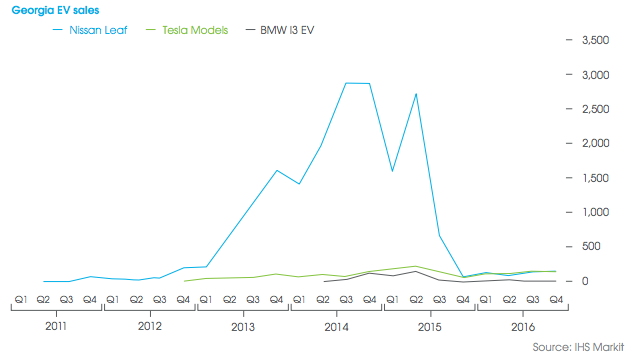

Oregon offer a rebate of 2500 for purchase or lease of new or used Tesla cars. The Clean Energy Act for America would benefit Tesla by allowing most Tesla vehicles to qualify for an 8000 House version or 10000 Senate version refundable EV electric vehicle tax credit while discouraging Chinese EVs from entering the US market. Georgia Tax Credit Prior to July 1 2015 Georgia allowed a generous tax credit for the purchase or lease of new BEVs.

Tesla Could Receive a Bump From a New 7000 Tax Credit Proposed reforms for the federal incentive program for electric vehicles would grant Tesla access to. Battery pack bonus. Ive talked to my cpa trolled the internet and im still not satisfied.

Income Tax Credit Utilization Reports. A Georgia taxpayer may claim a state income tax credit for the conversion of a conventionally fueled vehicle to an alternative fuel vehicle AFV. Income Tax Letter Rulings.

For Teslas this isnt a problem as the minimum is well over this threshold. The Consolidated Appropriations Act of 2021 signed December 27 2020 provided a two-year extension of the Investment Tax Credit for solar. You can get a tax credit of 25 for any alternative fuel infrastructure project including building an electric charging station.

In May 2021 the Senate finance committee considered the Clean Energy for America Act that suggested modifications to a number of existing programs associated with clean energy among them being the EV tax credit. 11th 2021 622 am PT FredericLambert Tesla and GM. State Local and Utility Incentives.

Georgia Power customers may be eligible to receive up to a 250 rebate for installing a Level 2 Charger in their home. The next administration wants to expand the federal tax credit for EVs who have already hit the threshold. The dates above reflect the extension.

Here S Every Electric Vehicle That Currently Qualifies For The Us Federal Tax Credit Electrek

Pros And Cons Of Buying An Electric Vehicle In 2020 Vs 2021 Aspentimes Com

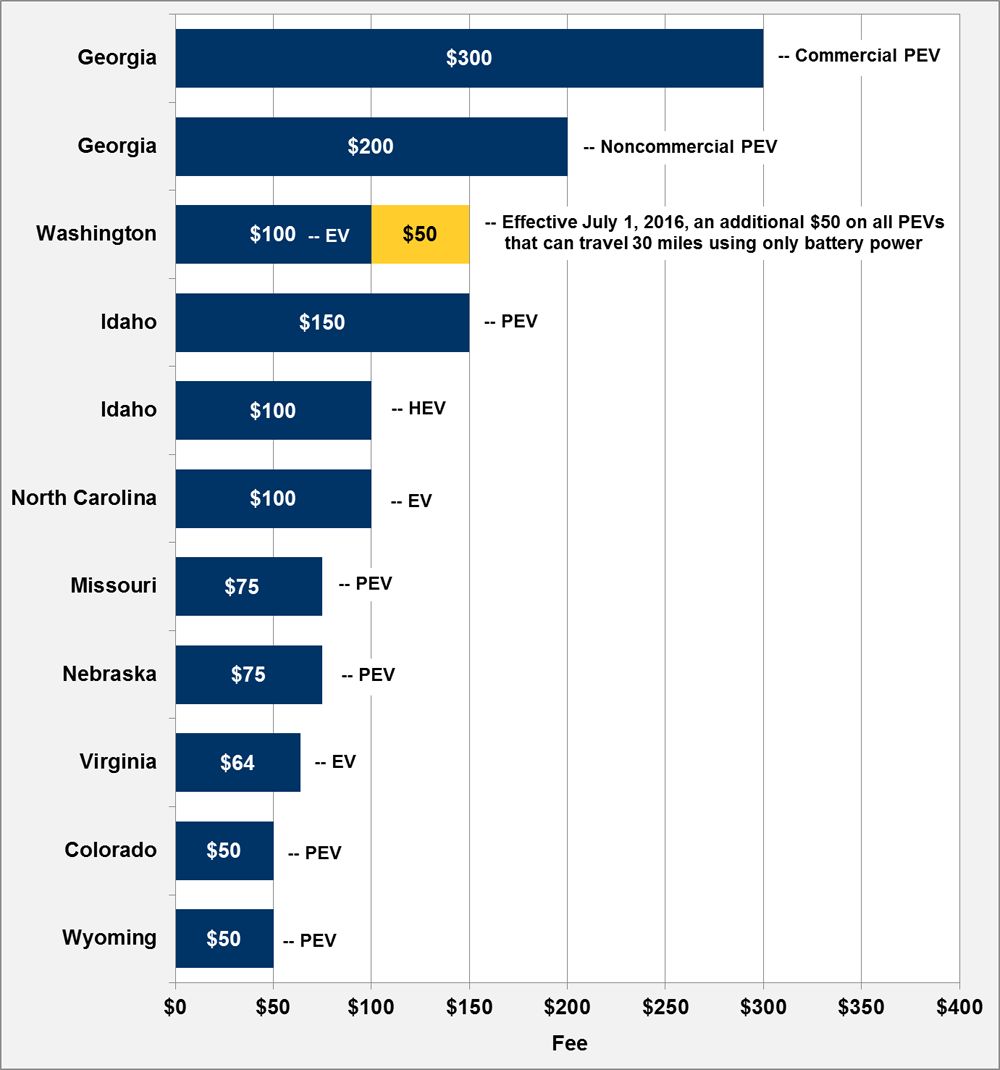

Updated 17 States Now Charge Fees For Electric Vehicles Greentech Media

Electric Cars Are Better For The Planet And Often Your Budget Too The New York Times

Charged Evs Parsing The Latest Proposal To Revamp The Federal Ev Tax Credit Charged Evs

Current Ev Registrations In The Us How Does Your State Stack Up Electrek

Updated 17 States Now Charge Fees For Electric Vehicles Greentech Media

Tesla S 7 500 Tax Credit Goes Poof But Buyers May Benefit Wired

Plug In Electric Vehicles In Norway Wikipedia

Latest On Tesla Ev Tax Credit March 2022

Edmunds Elimination Of Federal Tax Credits Likely To Kill U S Ev Market Wrong Evadoption

/ap814720993638-5bfc383d46e0fb0051c14a81.jpg)

Tesla Cost Of Ownership Is It Worth It

As Georgia Recruits Electric Vehicle Maker Rivian The Number Of Evs And Charging Stations Lags

As Georgia Recruits Electric Vehicle Maker Rivian The Number Of Evs And Charging Stations Lags

Here S Every Electric Vehicle That Currently Qualifies For The Us Federal Tax Credit Electrek

Electric Cars Are Better For The Planet And Often Your Budget Too The New York Times

Tesla Could Receive A Bump From A New 7 000 Tax Credit

Electric Vehicle Tax Credit For 2022 The Complete Guide Leafscore